The one with philosophy and ALL the emotions

Isn't buying real estate all about saving rent? A cold, hard look at the maths behind living in vs. renting out

You came here to read about real estate. Sure. Will you bear with me if I confront you with a little sidestep on moral philosophy, though? I know, I know, quite the risk it seems, in the second edition of this newsletter no less (here’s the first, if you care). Please allow me to explain why I think David Hume, a Scottish Enlightenment philosopher, historian and economist, born in 1711 and often depicted wearing what some confused Reddit users believe to be a showercap, is relevant as I am trying to make a very real estate point: I want to talk about emotions.

“Scotish man wearing turban” says (much like modern psychology): The human mind is basically divided into two parts. One that automatically processes information, often in a flash, and one that is much more controlled. To be human is to feel pulled in different directions (and ain’t that the truth - it feels pretty acute writing this as my stomach tries to pull me into the kitchen). One of Hume’s more famous theories outlines that reason evolved only to serve our “passions” - meaning that we basically make emotional decisions all the time. Afterwards, our controlled mind simply adds a layer of rational explanation. Sounds like a relatable stance, honestly, and one that I am forever going to use as an excuse for going with my gut.

Like claiming that we did - buying a house to rent it out instead of investing in real estate that you actually live in yourself - was the right decision. A better, superior decision somehow. It certainly felt right to us at that time and years later - still not regretting it. Sure, I could have probably used that money to buy an apartment for myself and forever be done paying rent (which for most people in Germany is the biggest monthly living expense). But we decided differently, maybe even in a flash, and Hume and I feel good about it. Here’s a few reasons my mind has made up to justify the investment property for your kind consideration:

One word: flexibility. While I totally understand that this is more or less important based on everyone’s current living situation - for me flexibility plays a huge role while life planning. If you are married with several kids, chances are you are not going to pack up your life and move to Bali tmrw. But in case that surf-chasing lifestyle is my jam next year - my investment property is here to stay while I might not. I would argue it’s just easier to pack up and go if you solely leave your rental as opposed to a living situation you have painstakingly (and expensively) created for yourself. And thanks to the German mouthful “Sondereigentumsverwaltung” (which is a long word for property managers), an investment property really doesn’t require you living in the same timezone, let alone area code anymore (speaking of: we hope the Google translate links are useful for when there’s really no English speaking sources - consider it real estate AND language learning opportunity in one, so to speak)

It seems that it’s a common mistake to think about the costs of living in a rental vs. in something you own in somewhat limited terms. If you simplistically only take into account rent on the one hand and mortgage and interest payments on the other hand, you are missing whole buckets of costs that can make a real difference. Take Hausgeld for example: The “house money” contains communal costs like cleaning sidewalks and the like as well as deposits to the house`s common wallet for future repairs. While you will always have to pay some of Hausgeld yourself, if your apartment is rented out, parts of these fees will be covered by your tenant. If you inhabit your property yourself it just means that there’s something else to be paid on top of interest and loan payments. While it might seem smart to invest in where you live a cold-hearted calculation might actually reveal that you are better off with an investment property that you don’t live in while paying rent somewhere else.

The second big money factor: for a rented property, parts of your investment are tax deductible. More on that below, given it’s the juicy part.

And lastly, and since we are on the topic of emotions anyway: I just know that it would be really hard to put a price tag on my dreams - I kinda know that if I was to buy real estate to live in it myself all rational thoughts would go out the window. Because buying real estate is such a big deal and often a once-in-a-lifetime scenario, I am not sure I would repeatedly stay strong enough to make sound investment choices. A roof terrace! The Nancy Meyer kitchen! Less emotions make for a clearer view at potential investments with fewer things to consider. It doesn’t have to be your dream home - it just has to appeal to someone out there.

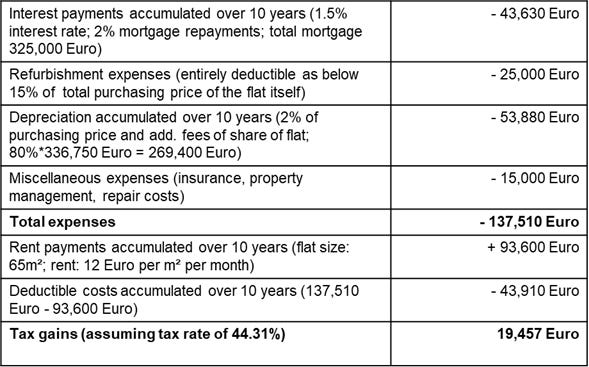

If Hume isn’t enough to fully lean into the emotional side of your real estate decisions (or you simply hope to provide an even better cover for the irrational decision you know you want to make anyway) - fear not, we are here to help. Take the below model calculation my esteemed co-writer and consultant extraordinaire put together. You did come here for the real estate facts - not the philosophy ramblings. I understand.

Let’s get to it.

For math’s sake, let’s assume you can get a 325,000 Euro mortgage to fully finance a property. 300,000 Euros for the pure, baseline, real estate bones of a place, 25,000 Euros set aside for renovations. Fees and additional purchase costs are on you - in this (theoretical) case that amounts to 36,750 Euro which covers agent’s fees, real estate transfer tax as well as the notarized listing in the land register. Cool? Cool. For simplicity’s sake, let’s arbitrarily pick a timeline and, um …. add interest payments for the next 10 years let’s say. If you assume an interest rate of 1.5% (a word of caution: even a slight difference of a decimal point or two can make a HUGE difference in the overall costs - but we have to pick a number) that leaves you with interest payments of 43,630 Euro (again, total over 10 years).

If you now do what some people think is the obvious thing to do …. you buy a car - you drive it. You buy pants - you wear them. Ergo, you buy a flat and … well, you get the point - you move in … well, then these are the initial costs you are dealing with. For easy overview:

43,630 Euro interest payments

= 10 years at 1.5% interest (assuming 2% repayment per year) for a loan of 325,000 Euro

36,750 Euro additional purchase costs

= Notary and landregister (in Hamburg) 1.5% = 4,500 Euro;

= Real estate transfer tax (again, in Hamburg) 4.5% = 13,500 Euro;

= Realtor’s fee 6.25% = 18,750 Euro

Renting your place out, however, this is where things get complicated. You initially have the same costs as above. But on the other hand, there’s three key components to your calculation that are important to understand:

Depreciation is tax deductible. I know, right? 2% of your purchasing price PLUS additional purchase costs can be deducted from your tax burden annually. Note that this only applies to the actual property, not the land it sits on. We are assuming an 80/20 ratio (see below).

The 25k you put aside for renovations - those are actually tax deductible as well, in full and immediately. This great thing happens because your renovation costs stay below 15% of the total cost of your real estate purchase. If you were above that threshold, renovation would be considered “anschaffungsnaher Aufwand” if you want to google that delightful German phrase. Basically a bureaucratic rule that states that renovation costs that are ABOVE 15% of the total cost (again, of just the property, not the land) in the first three years after purchase would be treated like depreciation at a rate of 2% over 50 years.

And lastly, big and fun difference if you are renting out: you can collect rent payments. Duh.

So all of the sudden, you have a different picture - one that has higher expenditures on the one side and income that you need to balance against those on the other. Plus the opportunity to deduct certain costs like renovations (up to a limit), miscellaneous costs like insurances as well as depreciation (which is a theoretical cost - but let’s ignore that real quick in the interest of not overcomplicating matters).

For the people in the back: Case calculation over 10 years

Before I lose you with all the numbers and calculations and arbitrarily picked variables, the Tl;dr: is this: Your tax deduction is pretty immense. The kind of “immense” that amounts to a whopping 20,000 Euros - which you could consider a sizable discount on your purchasing price if you will.

So while I have been pretty firmly in the “never buy a house or flat to live in it” camp - and now understand that the many reasons I gave for that probably have a lot to do with my very innate sense of independence and freedom - the numbers quite literally add up.

The main takeaways?

Emotions play a huge part in any (real estate) decision - and that’s okay. Your life and living situation will most likely dictate what makes sense at any given point, more than a tax break ever can. So it totally makes sense to consider the emotional side of real estate - and then see whether the math aligns.

Given every single variable can make or break a calculation, it’s important to play around with the numbers and look at different scenarios which will give you a sense of where the most important levers lie. Try and understand the underlying numbers as well as different cost categories and tax implications, no matter whether you buy to live or rent out. There’s professionals to help with that if needed. Or there’s tools and resources online if you think you want to give it a go alone.

As a rule of thumb, though: it’s easy to underestimate the costs of living in your own flat while it’s similarly easy to underestimate the tax savings you could realize when renting out a purchased property.

The Humes shower cap is available for sale. Just saying.

Next time, on Rente aus Stein: How friendship and real estate mix (or don't mix).

Make sure to subscribe to not miss this!

Disclaimer: We are not lawyers (sadly) and as such can’t give you legal and/or tax advise. We are simply telling our story in the hope that it’s inspiring to you.